Pension contributions missing: STEVE WEBB addresses reason for 8% salary Shortfall

Look, buddy, I'm gonna spill the beans on your workplace pension, since you're curious and all. Seems like the big retail chain you're working for has this 8% agreement for pension contributions, huh? That's you, yourself, and the employer chucking 4% each. Sounds straightforward, right? But then you run into this £480 threshold thingy! Au contrair!

I did a little digging, and here's the deal: Pensions are all about ensuring you don't crash and burn with no income once you retire. Majority of the folks aim to secure around two-thirds of their pre-retirement income once they're done working, and that's achievable cause they usually don't have hefty bills like mortgages, travel expenses, and stuff anymore, plus they stop paying National Insurance.

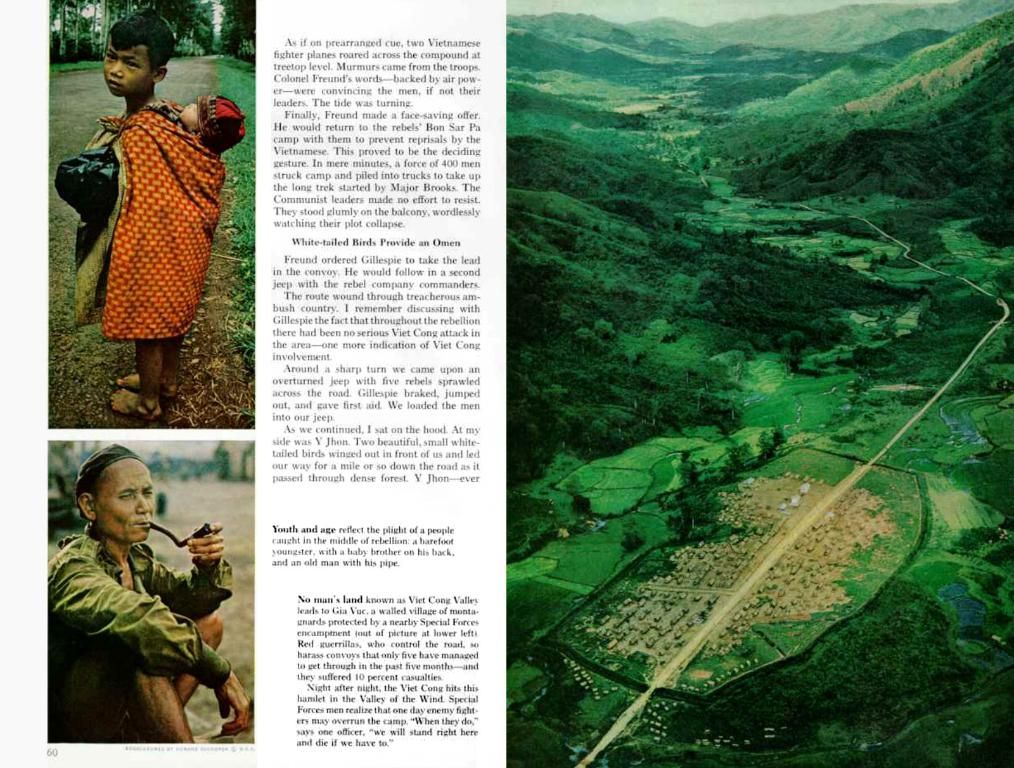

Now, the state pension replaces a little under one-third of the average worker's wage as a rough estimate. Since the state pension ain't exactly enough, we gotta add some private pension funds to reach that two-thirds target. Automatic enrolment was designed to require workers and employers to make pension contributions at a set percentage rate, but these contributions were applied to earnings above a floor, currently £6,240 per year.

This implies that pension contributions are based on earnings earning above that floor, and it's a bummer for part-timers cause the mandatory pension saving rate only applies to half their wage. On the other hand, someone working full time on a higher income makes contributions based on a larger chunk of their total wage.

The Government reviewed automatic enrolment a while back and suggested that the starting point for contributions be reduced to zero, so that the 8% headline figure would apply to all earnings up to the ceiling, currently £50,270. However, nothing much has changed yet, sadly. It's looking like further reform is a long shot since it's more costly for both employers and employees and considering the ongoing 'cost of living' crisis and the upcoming increase in employer National Insurance in 2024.

There is a glimmer of hope though: The Government is expected to announce the second phase of its major review of pensions soon and may address the adequacy of existing pension saving rates. Perhaps they might eventually recommend mandatory contributions based on the first pound of earnings, but even if they did, the implementation process could take a while.

Don't forget, there's more to learn about pensions! You can check out Steve Webb's answers to other readers' questions about the state pension and contracting out. Find the best Sipps out there to build your pension and get cracking!

[1] The Pension Regulator, "Automatic enrolment: The facts"[2] GOV.UK, "Automatic enrolment: The Basics"[3] GOV.UK, "National Insurance Contributions (NICs) Lower Earnings Limit and Upper Earnings Limit"[4] GOV.UK, "National Minimum Wage Rates"[5] The Pension Regulator, "Workplace Pension Employer Costs"

- To ensure a comfortable retirement and reach the target of two-thirds of pre-retirement income, it's essential to invest in private pension funds aside from the state pension, as the state pension only replaces a little under one-third of the average worker's wage.

- For effective financial planning and personal-finance management, seeking financial advice from wealth-management professionals and education-and-self-development resources can provide valuable insights on investment strategies and pension options.

- In the process of career development, it's crucial to consider the impact of pensions on long-term wealth, as many employers offer pension contributions as part of their benefits package, providing additional funds for retirement plans.

- This mention of workplace pensions highlights the importance of business decision-making in offering competitive pension plans, as these benefits can play a significant role in employee motivation and job satisfaction.

- Aside from pensions, insurance is another essential aspect of financial management, offering protection to individuals and families against unexpected events that could impact their finances and well-being in the short and long term.